Bitcoin looks set for a massive price swing either way based on the prolonged contraction its price volatility. However, it isn’t clea rwhich way the top-ranked cryptocurrency would move once the price swing occurs.

Narrowing Bitcoin Price Volatility

Since plummeting to $6,000 in February 2018, Bitcoin has maintained a broadly consistent price range that has remained above $6,000 for most of the year so far. Barring any sudden price movements in the remainder of Q3 2018, the $8,400 reached in late July represents the highest price valuation for the last three months.

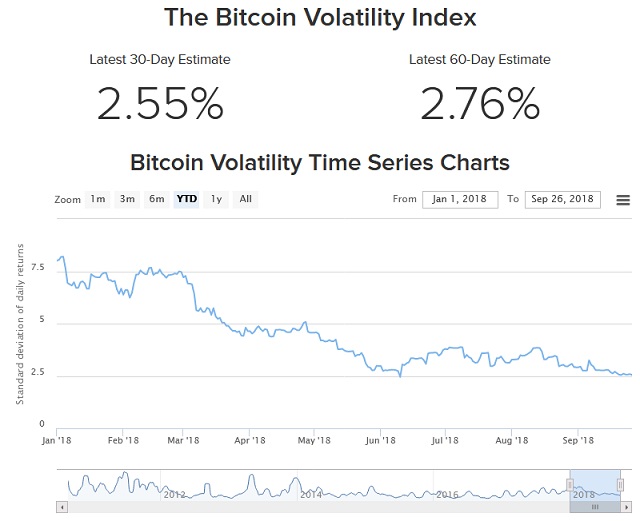

In Q3 2018, the BTC price volatility fell to 3.12 percent. For a volatile asset like cryptocurrencies, such a figure alludes to some form of stability. Declining liquidity in the market sees sideways gains and losses dominating the market.

Bitcoin’s 30-day and 60-day volatility estimates are even much lower, at 2.53 percent and 2.75 percent respectively. It appears the BTC market has stalled significantly due to the slow pace of institutional investors into the industry.

Many big-money players are still reticent given the lack of robust custodial solutions and the still nascent regulatory environment.

A Coin Toss: Rally or Plummet

From a technical analysis perspective, narrowing price volatility that remains for an extended period represents some form of substantial bias. Thus, the top-ranked cryptocurrency may be set for a massive price swing.

Looking at price action only, BTC appears firmly in a “pennant pattern” – the asset experiences sharp spikes followed sideways trading and then a decline. At the same time, price volatility continues to descend to levels not seen in almost two years. This trend means lower highs and higher lows.

Indeed, since the start of the year, BTC’s highs after every breakout has consistently declined. At the beginning of March, Bitcoin rose to $11, 400. In May, it was $9,800, and then in July, $8,400. It is a coin toss as to which direction the asset will move when the next breakout occurs, given the narrow volatility.

$6,000: A Critical Bitcoin Price Level

Presently, many experts agree that $6,000 is the critical level for BTC. Some even go as far as calling it the price bottom. Whenever Bitcoin has tested $6,000 buyers have managed to pump the price back above this level.

However, with a breakout looming, it is difficult to tell whether this “price bottom” will hold. If Bitcoin can’t hold that bottom, then it is likely that volatility will increase, sending the price to a new base.

For people like Arthur Hayes of Bitmex, BTC will test $5,000 before bouncing to a new all-time high before the end of the year. With the last quarter of 2018 set to begin in a few days, cryptocurrency enthusiasts are sure in for a ride.

Image courtesy of Buy Bitcoin Worldwide and Bitvol.info.