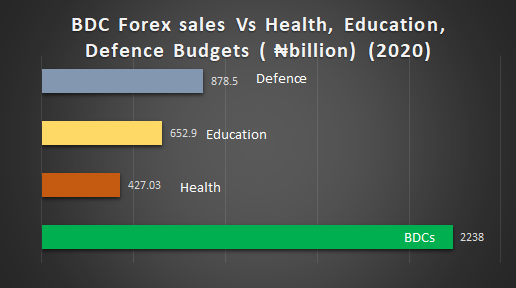

The Nigerian government through the Central Bank of Nigeria (CBN) spent over N2.24 trillion ($5.46 billion) on funding the businesses of Bureaux de Change (BDC) operators in 2020 than its resources allocated to education, health and defence sectors.

The BDCs received more of the share of Nigeria’s resources than critical sectors that encourage investments and contribute to the Gross Domestic Product (GDP) of the economy.

BizWatch Nigeria’s analyses showed that last year, the Central Bank of Nigeria’s foreign exchange sales to BDC operators was equivalent to about 21.67 per cent of the National Budget of N10.33 trillion.

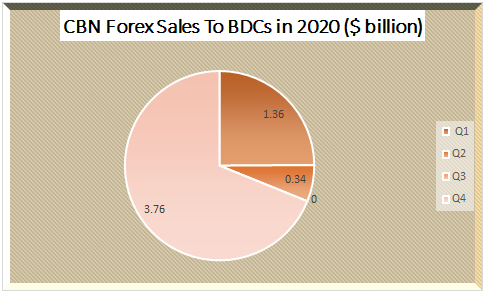

A breakdown of the data from the CBN showed that in the first quarter of 2020, forex sales to BDCs was $3.76 billion, none in the second quarter of 2020, $0.34 billion in the third quarter and $1.36 billion in the fourth quarter of 2020.

Whereas, only 4.13 per cent of the 2020 National Budget was assigned to the health sector, 6.32 per cent to the education sector and 8.5 per cent to the Defence sector.

Despite promises to dedicate 15 per cent of the annual budget to the health sector, only N427.03 billion of the 2020 budget was allocated to cater to the salaries of all health workers, management of health facilities, research, management of disease outbreak, vaccine distribution and administration, fuelling of the ambulances, management of malaria, tuberculosis, cholera, meningitis, HIV/AIDS, cancer and other life-threatening diseases.

READ ALSO: MAN Urges Banks Not To Hoard Forex After CBN Directive

The education sector got N652.9 billion (6.32 percent) funding in 2020, against the 16.7 percent of national budget recommended by UNESCO.

The Defence sector, which is critical to the fight against insecurity that has over the years caused a setback for Nigeria’s economy, received N878.5 billion allocation from the government last year.

Economic reports from the CBN showed that N5.32 trillion foreign exchange sales to BDC in 2020 was one of the lowest due to the temporary suspension of forex sales to BDCs on March 27, 2020, as a result of the suspension of international travels.

With the re-opening of the airports for international travel, the CBN resumed forex sales to the BDCs in September 2020.

In 2019, a total of $12.65 billion was sold to the BDCs in the country.

A breakdown of the CBN report showed that in 2019, BDCs got $2.44billion in the first quarter; $3.33 billion in the second quarter, $3.54 billion in the third quarter and $3.34 billion in the fourth quarter.

CBNs’ New Forex Regulation

The comparison of BDCs’ funding to the Health, Education and Defence sector became necessary due to the decision by the CBN to suspend sale of forex to BDC operators.

The CBN Governor, Godwin Emefiele, had last week announced the immediate end of forex sale to the Bureau De Change operators in the country.

He also said the apex bank will no longer continue registration of new BDCs as subsequent forex will be channelled through commercial banks.

Emefiele accused the BDC operators of compounding the pains of retailers sourcing for foreign exchange and had become conduit for illegal activities.

“The Central Bank will henceforth discontinue the sale of forex to Bureau de Change operators,” Emefiele said.

He added, “The CBN also observed that the BDCs aid illicit financial flows and other financial crimes. The bank has thus decided to discontinue the forex sales to BDCs with immediate effect.

“We shall, henceforth, channel all forex allocation through the commercial banks,” he said.

The CBN Governor expressed disappointment and great concern that the BDCs had defeated the purpose of their existence.

The BDCs were regulated to sell a maximum of 5,000 dollars per day, but CBN observed that they have since been flouting that regulation and selling millions of dollars per day.

He directed all commercial bank branches to create a separate desk for forex sales as part of the new policy.

Calls For Unification Of Forex Windows

For many years, economists and the international financial organisations have advised the Federal Government to unify Nigeria’s forex market as it was discouraging investors.

The International Monetary Fund (IMF) had earlier this year pointed out that the multiple forex windows and unclear rules of FX allocation was createing uncertainties for the private sector.

It advised the Nigerian government to unify the various rates into one market-clearing rate, so as to establish policy credibility, foster domestic industrialisation and attract larger capital inflows, including Foreign Direct Investments (FDI).

The IMF said, “All exchange rates should be collapsed into one well-functioning market exchange rate withthe CBN conducting FX auctions through a pre-announced schedule following the immediate steps.

“This should be accompanied by a gradual removal of import restrictions and export repatriation requirements and the phasing out of capital flow measures (CFMs).”

In the medium-term, the IMF advised that “the CBN should step back from its role of main FX intermediator in the country, limiting interventions to smoothing market volatility and allowing banks to freely determine FX buy-sell rates.”

The Director-General of the World Trade Organisation (WTO), Dr Ngozi Okonjo-Iweala, also in March this year warned that Nigeria’s multiple exchange rate window was been a cause for concern to trade partners and the WTO.