This guide on Bitcoin by Vpnmentor will explain the nitty-gritty concepts relating to blockchain and Bitcoin in an easy-to-understand manner. It’s a long read, so we broke it down into digestible sections.

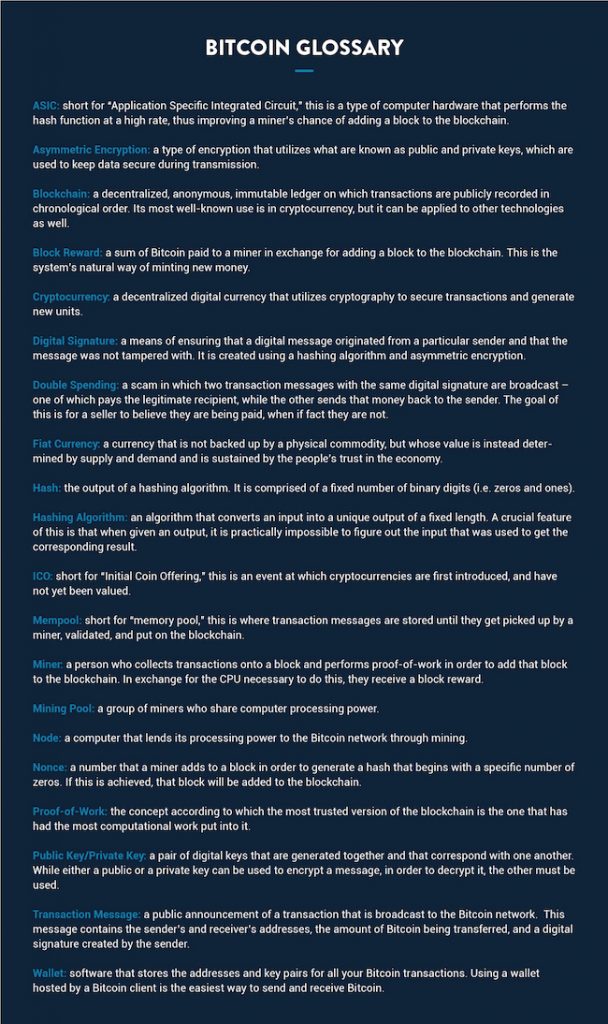

The concept of Bitcoin and blockchain includes a lot of specific terms. For quick definitions, you can reference this glossary.

Invention of Bitcoin

Bitcoin was invented by an anonymous person under the pseudonym Satoshi Nakamoto. In October 2008, Nakamoto published a paper on blockchain and circulated it throughout the cryptographic community.

In 2009, Nakamoto completed the Bitcoin software’s code and invited other people from the open-source community to contribute.

He mined the first block himself on January 3, 2009. As per the public records of his Bitcoin addresses, Nakamoto currently owns Bitcoin worth over $40 billion, making him one of the wealthiest people in the world.

The Bitcoin Protocol

Bitcoin Authenticates the User with a Digital Signature

When you go to a bank to perform a transaction, it needs you to authenticate yourself. You may do this with your driver’s license, social security card, or handwritten signature. In any case, these mechanisms are in place so that only you can withdraw or transfer money that you own. If someone tries to impersonate you, he would be caught (hopefully).

As has been explained above, Bitcoin utilizes a public ledger, on which everyone records their transactions. But what’s to keep people from adding fraudulent transactions that benefit them? For instance, Bob could simply add to the ledger that Alice sent him money.

READ ALSO: CP Orders Dismantling Of Illegal Roadblocks Along Lagos-Badagry Road

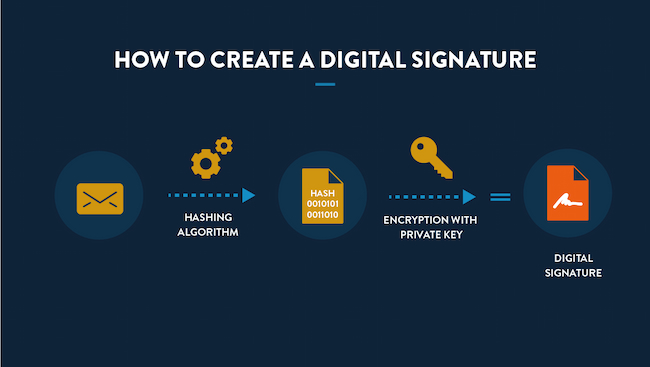

To prevent this, transactions are broadcast to the network along with a digital signature.

A digital signature ensures two things:

The designated sender has sent the message.

The message has not been tampered with.

This digital signature is created using a hashing algorithm and asymmetric encryption.

Hashing uses an algorithm that irreversibly converts an input into a unique output of a fixed length. Bitcoin’s hashing algorithm is SHA256, which means the output – also known as a hash or digest – has 256 binary digits (i.e., zeros and ones).

How To Carry Out Transactions

Suppose Alice wants to send one Bitcoin to Bob.

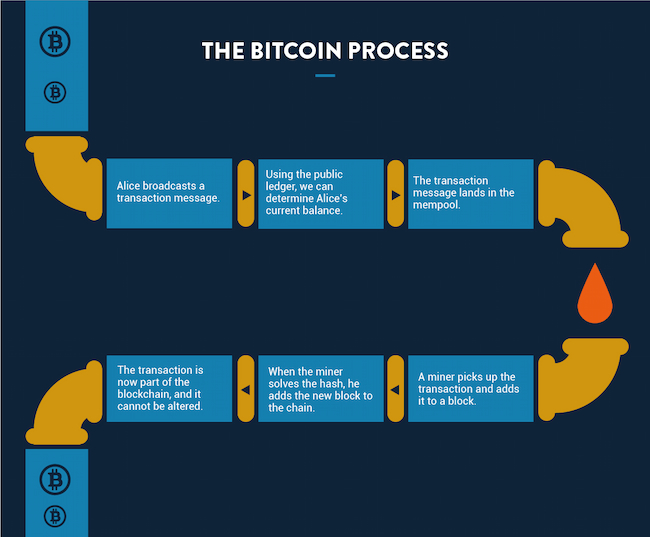

First, we need to verify that Alice owns at least one Bitcoin. There is no single entry in the blockchain network where you can see how much currency a person holds. Instead, the balance is derived by calculating all previous transactions, known as the transaction chain.

When you first download the Bitcoin software, you receive a complete copy of the transaction chain (which is why downloading can take up to 24 hours). Once you have the transaction chain, it’s easy to determine Alice’s current balance.

Once it’s verified that Alice owns enough Bitcoin to make the transaction, the next step is to broadcast the transaction message. This message contains the sender’s and receiver’s addresses, the amount being transferred, and the sender’s digital signature. When broadcast publicly, any node in the network can relay the message and pick it up for execution.

Before its executed, the transaction is added to a pool of unconfirmed transactions before it is executed, known as a mempool (short for ‘memory pool’). From there, it’s picked up by miners.

Miners are basically the mediators who validate transactions. (This will be explained in more detail below.) Once the transaction is validated, the miner adds it to the newest block. A block has a fixed size, so a new block must be created after a certain number of transactions. The current block is linked to the previous block, forming a blockchain.

How to Use Bitcoin

There are numerous ways you can use Bitcoin, but all basically involve the same process. There are three steps to using Bitcoin: acquiring Bitcoin, managing your wallet, and trading Bitcoin for goods and services. Let’s look at the steps one by one:

Acquiring Bitcoin

Besides mining Bitcoin (which we discuss in Section 2), you can simply purchase it. This can be done through an online exchange or by making an Over The Counter (OTC) transaction.

OTC transactions are trades made with another individual – generally via a broker who manages negotiations. This is the favored method for those seeking to buy substantial sums of Bitcoin (i.e., in the hundreds of thousands or millions of dollars worth). This is because exchanges don’t have the liquidity to facilitate such large transactions.

Although OTC trades aren’t regulated like exchanges, a reputable broker will ensure that no fraud occurs. Some high profile brokers include China-based Richfund, New York’s Genesis Global Trading, and London-based Bitstocks.credit.

For the ordinary Bitcoin user, exchanges, such as Coinbase, Coinmama, or itBit are the safest and easiest way to procure Bitcoin. To avoid foreign exchange fees, it’s best to buy from an exchange in your country, which are typically directly integrated with local banks.

Exchanges are straightforward to navigate. You just go to the website and follow the sign-up instructions, and you can get started buying Bitcoin right away.

What’s important to note is that most exchanges require personal information such as your name, email, and phone number. And obviously, if you’re using your credit card to buy Bitcoin, or are doing so via a bank transfer, it will have that information too.

If you choose to use an exchange, this point in the process – when you buy or sell Bitcoin – is when you can lose your anonymity.

Managing Your Wallet

On the Bitcoin network, owning Bitcoin simply means having an address and private key. As we discussed above, this private key allows you to encrypt digital signatures.

Without a private key, you have no access to your Bitcoin and no way of proving that it belongs to you, so you should keep it in as secure a place as possible.

You receive a private key when you are issued a Bitcoin address. The key is a 256-bit length of data, which can also be represented alphanumerically. For example, people sometimes use it in hexadecimal form – meaning 64 characters in the range of 0-9 or A-F. The most common option is to use the Wallet Import Format (WIF), which is 51 alphanumeric characters, the first of which is always the number 5.

Here’s an example of a WIF private key:

5KJvsngHeMpm884wtkJNzQGaCErckhHJBGFsvd3VyK5qMZXj3hS

Losing your private key is like losing your Bitcoin. If you lose your private key, you cannot recover your Bitcoin. Similarly, if someone else gets hold of your private key, then he or she can withdraw all your Bitcoin.

So, how do you protect your private keys and your coins?

One option is to store your coins offline. Storing your coins and private key on a USB drive ensures that attackers and hackers cannot steal your information. However, if you lose that drive – or if someone manages to steal it physically – you’re out of luck.

Another option is to store your Bitcoin with a third-party provider – or client – that offers a Bitcoin wallet. This is a type of software that stores the addresses and key pairs for all your Bitcoin transactions.

However, the growing number of attacks these days targeting crypto exchanges have made it slightly unsafe to store your keys with them. Experts recommended you store your keys offline.

Making Transactions Using Bitcoin

Making transactions using Bitcoin is very simple. If you have a specific person to whom you want to send money, you just need their Bitcoin address, which you enter into your Bitcoin client. If the person you’re sending money to uses the same client as you, you often need to enter the email address to which they linked their account.

Online businesses that accept Bitcoin usually have a button that you click that will automatically bring you to your wallet, allowing you to make the payment from there. For wallets installed on mobile devices, they often provide a QR code to scan with your phone.

How to Make Money from Cryptocurrency

Blockchain technology is completely new and there are plenty of opportunities to monetize it. There are basically two ways you can do that – through mining and investing.

Become a Miner

Mining is a slow but safe method of earning money from Bitcoin and other cryptocurrencies. As you recall, miners are the people on the network who validate transactions in exchange for a reward. In the case of Bitcoin, there are two types of rewards – one that is received for adding a new block, and the other for picking up a particular transaction.

Different cryptocurrencies have different mechanisms for paying miners; some may only pay for transaction fees, while others incentivize them using various other means.

You can participate in the mining process by donating CPU to the network. Because CPU requires electricity, it’s important to consider how your earnings from mining will compare to the costs you will incur. This will depend on the country you’re in and how cheap the electricity is there. The extremely low cost of electricity in China is the reason why the majority of the miner network resides there.

Other factors that will contribute to your calculation are the hash power of your hardware and the current price of Bitcoin.

For more serious miners, there is specialized hardware available with high hash rates that will give the miner better odds of solving a block. An ASIC (Application Specific Integrated Circuit) is the general term used for such a device. With the combination of an ASIC and cheap electricity, you could find it profitable to get into the mining business.

You can either be an individual miner or you can be a part of a group of miners who share CPU. The latter is known as a mining pool, and is generally a good idea for those without a lot of hardware. In a mining pool, members are paid in proportion to the amount of CPU power they contribute. For Bitcoin mining, the following pools are well known:

Bitfury – based in Georgia

BTC.com – based in China

Slush – based in the Czech Republic

For other cryptocurrencies, you’ll need to research which pools are worth joining. Generally, pools are created as soon as a currency starts gaining traction.

Invest in Cryptocurrency

Direct investment is a quick but risky way of making money from cryptocurrencies. If you do not have the time or resources for mining, you can simply purchase the cryptocurrency from an exchange. Bitcoin has shown astonishing returns over the past few years and has caught the attention of all sorts of investors.

While you can purchase crypto coins any time, there is a special time period when the opportunity for profit (and loss) is at its highest.

This is during the ICO (Initial Coin Offering). For those familiar with equity investing, you can say that it’s similar to an IPO (Initial Public Offering).

ICO is an event at which crypto coins are first introduced to the world and have not yet been valued. At that time potential investors assess the project and decide whether to invest in it. If the project is implemented and gains traction, the value of the coins rise, earning them a profit.

Let us look at some interesting stories where people bought Bitcoin and were shocked later on.

In 2009 a Norwegian student researching encryption bought 5,000 BTC for around $27, and then totally forgot about it. Four years later, when the media brought Bitcoin into the limelight, he remembered his purchase and was surprised to find that it was worth over $886,000. Half he sold in order to purchase a luxury home in a posh area of Oslo, and the rest is worth $28 million as per today’s exchange rate.

On May 22, 2010, computer programmer Laszlo Hanyecz bought two pizzas using Bitcoin. He paid around 10,000 BTC which at that time was only worth $41. However, at the current exchange rate, those Bitcoin are worth more than $377,843,000, making them the most expensive pizzas ever purchased. In an interview, Laszlo stated that since Bitcoin barely had any value back then, he was excited that he was able to buy anything with it.

James Howell, an IT engineer from Newport started mining Bitcoin using his laptop in 2009. He collected over 7,500 Bitcoin and then stopped. Later, he sold his laptop on eBay, but before doing so removed the hard disk where his Bitcoin private keys were stored. He kept the hard disk in a drawer hoping to cash out the Bitcoin when their value increased. But a few years later, during some house cleaning, the hard disk was thrown out by mistake. As per today’s exchange rate, the lost Bitcoin are worth over $85 million. James wanted to carry out a search operation at the landfill – an expensive and complex task – but due to environmental concerns and the possibility of hazardous gases leaking out, the operation was not carried out.