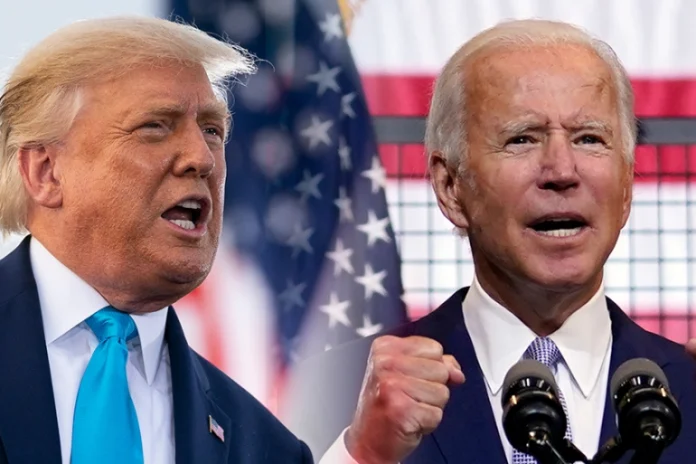

The re-election of Donald Trump as U.S. President, defeating Vice President Kamala Harris, sparks discussions on how his policies might influence global investment patterns in the years ahead.

During Trump’s initial term, Nigeria benefits from a significant increase in foreign capital inflows, receiving five times more than it does under President Joe Biden. Data reveals that Nigeria attracts a total of $10.5 billion in foreign investments during Trump’s four-year term, compared to just $2.39 billion under Biden so far.

Dissecting the Capital Inflow Disparity

Experts point to a combination of U.S. monetary policies, Nigeria’s interest rate strategies, and exchange rate stability as the key drivers that create a more favorable investment environment during Trump’s presidency.

A closer analysis shows that under Trump, Nigeria’s capital inflows grow steadily:

- 2016: $950 million

- 2017: $2.47 billion

- 2018: $3.58 billion

- 2019: $4.5 billion

By 2019, Nigeria’s total capital inflows peak at $23 billion, with the United States alone contributing $4.5 billion. In stark contrast, the country only attracts $2.39 billion in foreign capital under Biden’s administration, amounting to roughly a quarter of what was achieved during Trump’s term.

Key Factors Boosting Capital During Trump’s Era

Interest Rate Policies: The U.S. maintains relatively low interest rates during Trump’s presidency, making emerging markets like Nigeria more appealing to American investors looking for higher returns. Nigeria, in turn, offers attractive interest rates, particularly between 2017 and 2018, which draws in significant foreign portfolio investments. The higher yields on Nigerian government securities during this period prove to be a major pull factor for investors.

Exchange Rate Stability: From 2017 to 2019, the Central Bank of Nigeria (CBN) successfully stabilizes the naira at approximately N360 to $1, reducing currency risk for foreign investors. Stability in the exchange rate is a critical consideration for investments in emerging markets, where currency fluctuations can severely impact returns.

However, under Biden, the U.S. Federal Reserve increases interest rates to curb inflation, prompting investors to shift focus back to safer, higher-yielding assets in the U.S. This policy change, coupled with a stronger dollar, diminishes investor interest in riskier emerging markets like Nigeria, where challenges in maintaining currency stability intensify.

What Trump’s Second Term Could Mean for Nigeria

As Trump assumes office for a second term, there is anticipation around whether Nigeria will experience a resurgence in foreign capital inflows. If Trump reinstates his previous approach of promoting low interest rates, emerging markets like Nigeria could see renewed investment interest.

However, Nigeria’s ability to capitalize on this potential inflow depends largely on its own economic policies, particularly in the areas of exchange rate management, inflation control, and maintaining competitive interest rates.

Future Outlook for Nigeria’s Investment Landscape

Trump’s return to the White House presents Nigeria with a strategic opportunity to attract more foreign capital. For Nigeria to leverage this, policymakers must prioritize a stable investment environment by focusing on exchange rate predictability, competitive interest rates, and continued economic reforms. Aligning these factors could position Nigeria to benefit from favorable global investment trends during Trump’s second term, driving economic growth and enhancing financial stability.