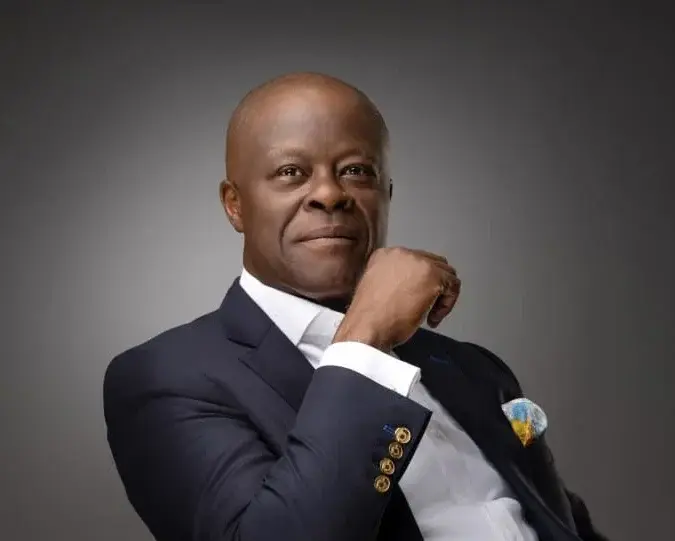

Mr Wale Edun, Minister of Finance, stated that the Federal Government aims to boost Internally Generated Revenue (IGR) by 77%. Edun, who is also the Coordinating Minister of the Economy, made the statement on Wednesday in Abuja, at the start of the Federal Inland Revenue Service’s 2024 Strategic Management Retreat.

According to Edun, taxes play an important part in the government’s efforts to increase income, which would assist bridge the infrastructural gap and construct social safety nets for ordinary Nigerians. He praised the FIRS’ administration for its dedication to achieve its income objective.

“It is commendable that the FIRS is holding this retreat at the beginning of the year to rub minds on how to increase government revenue.

“We are projecting a 77 per cent increase in IGR. Our revenue as a percentage of Gross Domestic Product (GDP) is low at below 10 per cent. It should be much higher.

“The government needs so much to spend on infrastructure and social services. The idea is to shift from expensive debts to domestic revenue mobilisation,” he said. The Executive Chairman, FIRS, Dr Zacch Adedeji, said that the retreat was a historic moment to unveil the new FIRS organisational structure, with the commitment to revolutionise tax administration in Nigeria.

According to Adedeji, the cornerstone of this paradigm shift is the establishment of a customer-centric organisational structure designed to streamline processes and enhance efficiency in tax operations.

“We are not merely adapting to change; we are leading it. The forthcoming structure set to kick off in February, embodies our dedication to modernise and digitise the tax administration landscape in Nigeria. In our pursuit of a more efficient and contemporary tax administration methodology, we are embracing an integrated tax approach, leveraging technology at every step.

“This approach positions FIRS at the forefront of innovation, ensuring that we meet the evolving needs of our taxpayers in a rapidly changing world,” he said. He said that the structure advocated for a comprehensive approach to taxpayer services, consolidating core functions and support under one umbrella.

“By tailoring our services to specific taxpayer segments, we aim to simplify the taxpayer experience. No more complexities, no more overlapping, just a seamless and user-friendly interaction for every taxpayer.

“In a groundbreaking move, we are shifting away from traditional tax categorisation. Instead of maintaining different departments for distinct tax categories, the new structure formulates taxpayer segments based on thresholds.

“This tailored approach ensures that taxpayers are guided and serviced according to their specific needs, eliminating confusion and redundancy in tax administration. Naira Steadies as Banks Issue Update on FX Purchase

“Behind this transformative initiative are carefully considered considerations detailed in our operations plan. We highlight the rationale behind our integrated approach, the benefits of comprehensive taxpayer services, and the logic behind tailored taxpayer categories, which will be presented to management in the subsequent sessions of this workshop.

“These considerations set the stage for a more responsive, efficient and user-friendly tax administration system,” he said. According to Amina Ado, Coordinating Director, Special Tax Operations Group, the FIRS has a revenue target of N19.4 trillion.

Ado said that the service surpassed its 2023 target of 10.7 trillion and generated N12.37 trillion. She said that the 2024 target of N19.4 trillion can be achieved partly through improved management of large taxpayers and sector contributors.