Student loan has been a trending topic ever since act was signed by the President of Nigeria, Bola Ahmed Tinubu.

The student loan has been a debate for sometime, after the act was signed, Nigerians have taken to the internet to express their concerns and some their excitement.

The purpose of the student loan is to reduce the financial burden of Nigerians in public institutions and to encourage the youth to get educated.

The Student Loan Bill was introduced by Femi Gbajabiamila, former speaker of the 9th House of Representatives, and was passed by lawmakers in late May 2023.

Gbajabiamila encouraged the Education Bank in November 2022 to make interest-free loans available to students in tertiary institutions in order to make paying education at that level more accessible to everybody.

On December 2022, the Academic Staff Union of Universities (ASUU) condemned the proposed introduction of education loans, claiming that they have been a colossal failure in Nigeria and other countries where they have been implemented.

There have been some concerns and controversies on the newly approved student loan. Some Nigerians are concerned about the sustainability of the loan, repayment and the effectiveness of the student loan.

Here’s why it may be difficult to access student loan

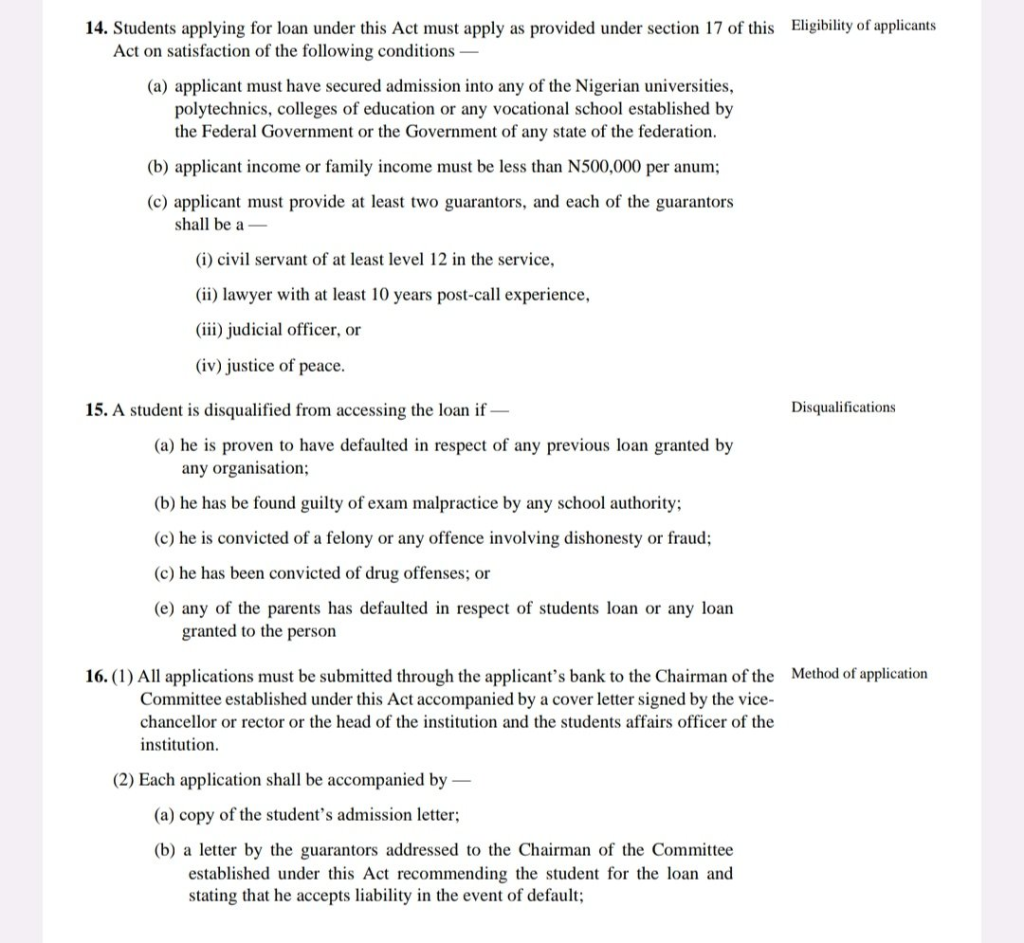

Family Income

One of the requirement of the loan is that the family income must be less that ₦500,000 per year. That means parent would be earning less than ₦30,000 which less than the minimum wage.

First of, financial inclusion is a problem meaning some Nigerians do not use banks or own an account. They hold onto their earnings and use it almost immediately on their needs. Without a bank account, how do you prove that you in deed qualify? Any organization that pays its employee below the minimum wage will be fined.

Tax Clearance

Let’s be honest only blue collar workers really pay tax, in fact not all of them pay tax what more of a petty trade or the poor. One of the requirements for the student loan is tax clearance and this may provide a major issue for kids whose parents do not have blue collared jobs.

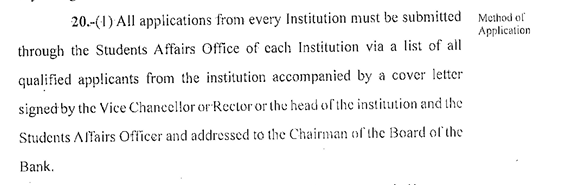

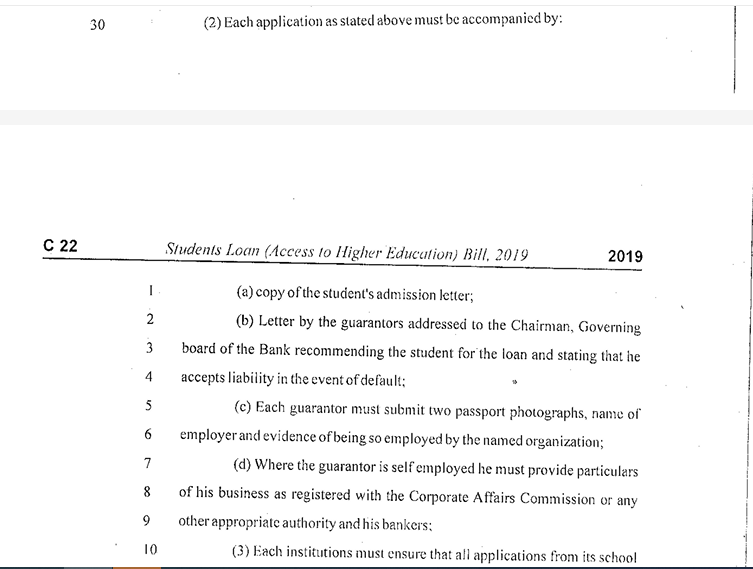

Thee struggle of applying for the student loan

One of the struggles would be getting a cover letter signed by the Vice-Chancellor, students hardly have access to them.

You must not have been convicted of any offense including money laundering and drugs, if you have according to the bill you will not get the loan.

Another thing to consider is will the students affairs department secretly bill the students who submit their letters for the sake of special treatment/access?

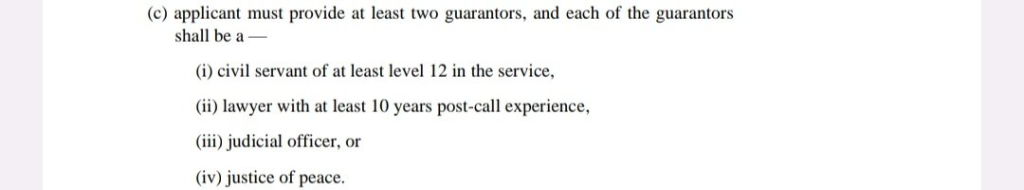

Guarantor

Do you know how hard it is to get a guarantor when you want to borrow a loan? I mean the one from a legit organization not the loan sharks.

Well, it is not easy. However any student that wants to qualify for the loan must have 2 guarantors and they must be public servants or judicial officers. How feasible is it to get any of the people in the list below? Remember that the government pays nothing less than the minimum wage.

Remember that if the student faults on the loan payment; the guarantor will be held responsible.

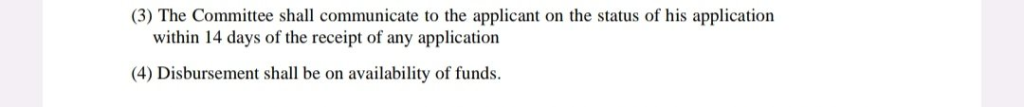

Availability of funds

There is a clause in the bill, the funds will be given based on availability; meaning is there is no money you request for student loan will most likely not be approved swiftly.

Bad credit

The approval of the loan is subject to the student/parent’s credit performance. This means that if you have defaulted on ANY loan payment, you have indirectly disqualified yourself.

You might want to quickly pay your loans.

The government is doing this to protect the system from chronic debtors.

In all, it will be nice to see how this loan plays out.