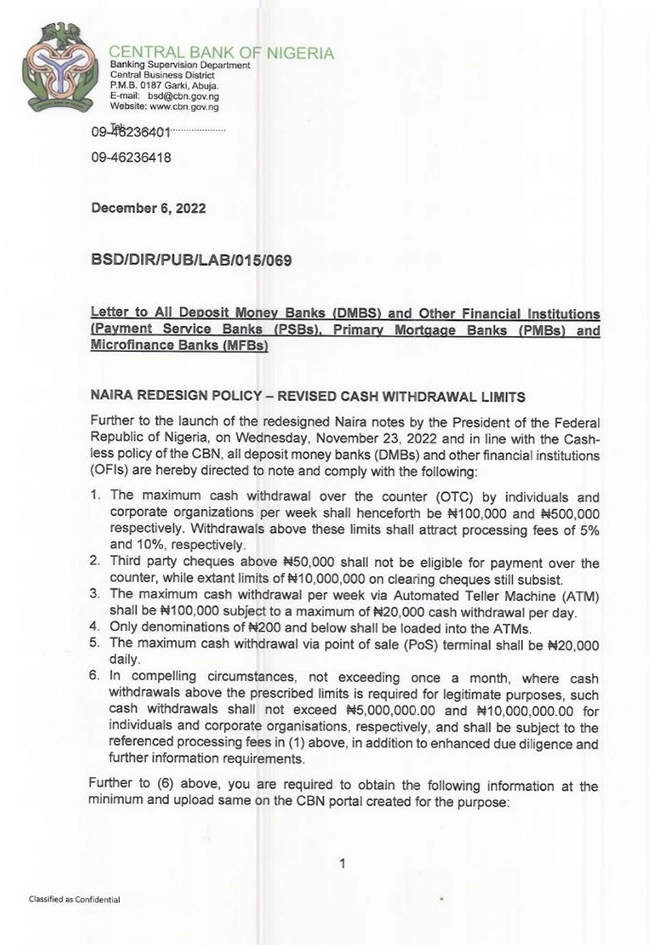

The Central Bank of Nigeria (CBN) has directed Deposit Money Banks (DMOs) and other financial institutions to ensure that individuals’ and corporate entities’ weekly Over-The-Counter (OTC) cash withdrawals do not exceed ₦100,000 and ₦500,000, respectively.

The central bank announced this in a circular signed by CBN Director of Banking Supervision Haruna Mustafa on Tuesday.

The apex bank stated that the regulatory directives will go into effect nationwide on January 9, 2023.

The CBN also set a daily withdrawal limit of ₦20,000 via Point of Sale (PoS) terminals.

“The maximum cash withdrawal per week via Automatic Teller Machine (ATM) shall be ₦100,000 subject to a maximum of ₦20,000 cash withdrawal per day.

“Only denominations of ₦200 and below shall be loaded into the ATMs,” the bank also said, adding that the new policy is sequel to the launch of the redesigned ₦200, ₦500 and ₦1,000 notes by President Muhammadu Buhari on November 23, 2022.

CBN Governor Godwin Emefiele announced the redesign of the three bank notes on October 26, 2022, stating that the new and existing currencies will remain legal tender and circulate together until January 31, 2023.

The central bank believes that the new notes will limit cash in circulation, thereby limiting the heinous activities of ransom-demanding kidnappers and politicians prone to rigging elections.

However, the Peoples Democratic Party (PDP) and some prominent Nigerians, including Edo State Governor Godwin Obaseki and the General Overseer of the Redeemed Christian Church of God (RCCG), Pastor Enoch Adeboye, have criticized the naira redesign as having no economic basis.

Read CBN’s full circular: