Data released on Thursday, November 2, showed worker productivity increased at its fastest pace in three years in the third quarter. It revealed the tightening labor market and improving productivity likely strengthen the case for the Federal Reserve raising interest rates in December, despite wage pressures remaining tame.

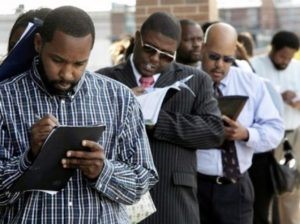

As shown, the number of Americans filing for unemployment benefits fell to a near 44-1/2-year low last week, supporting expectations of a sharp rebound in job growth in October after employment was depressed by hurricane-related disruptions in September 2017.

The Initial claims for state unemployment benefits decreased to 5,000 seasonally adjusted to 229,000 at the end of week for October, which is 28.

The labour department also said that the figure was not too far from 223,000, a 44-1/2-year low touched in mid-October. Economists had forecast claims rising to 235,000 in the latest week but the productivity in the week has dropped claims from an almost three-year high of 298,000 hit at the start of September in the aftermath of Hurricanes Harvey and Irma in Texas and Florida.

The Labor Department also said that claims-taking procedures continued to be severely disrupted in the parts of Virgin Islands. The situation in Puerto Rico had improved and backlogs were now being processed. Although, the hurricanes destroyed infrastructure, virtually cutting off communication with the islands.

The labor market is near full employment, with the jobless rate at a more than 16-1/2-year low of 4.2 percent.

The dollar also climbed slightly while prices for U.S. Treasuries were little changed and the Federal reserve kept interest rates unchanged on Wednesday, November 1.

The four-week moving average of initial claims, considered a better measure of labor market trends as it irons out week-to-week volatility, dropped 7,250 to 232,500 last week. That was the lowest reading since April 1973.

It also showed that payrolls increased by 310,000 jobs in October. The unemployment rate is seen unchanged at 4.2 percent.

Diminishing labor market slack was also underscored by shrinking unemployment rolls. The claims report showed the number of people still receiving benefits after an initial week of aid fell 15,000 to 1.88 million in the week ended Oct. 21, the lowest level since December 1973.