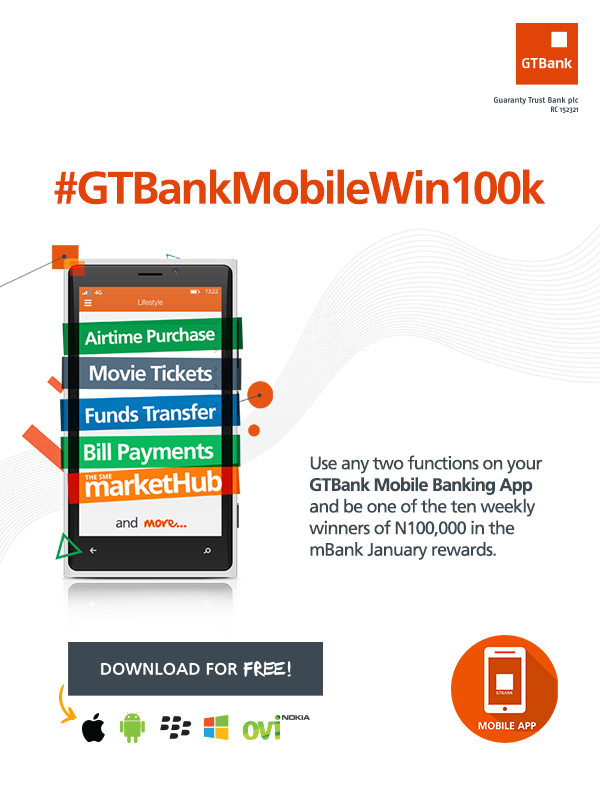

Foremost financial Institution; Guaranty Trust Bank (GTBank), has launched the #GTBankMobileWin100k competition to reward its mobile banking customers by availing them a chance to win N100,000 weekly in the mBank January rewards. The competition will run throughout the month of January 2016 and ten lucky customers will win N100,000 weekly during the period.

To participate in the competition, customers are required to perform two banking transactions weekly on the GTBank Mobile App, such transactions include funds transfers, airtime purchases, bills payments and purchases on the SME MarketHub. Multiple entries are allowed and winners will be notified by telephone or email.

The GTBank Mobile App is a versatile mobile application that merges the bank’s internet banking and mobile money service offerings to allow customers enjoy 24/7 flexibility in carrying out banking transactions without having to visit the Bank’s offices. Using the mobile app, customers can confirm transactions, transfer funds, pay bills and check balances from the comfort of their mobile devices.

The app also host other amazing features such as the SME MarketHub; an online e-commerce platform that allows businesses owners create online stores to sell and promote their offerings to millions of buyers online.

Commenting on the launch, Segun Agbaje, Managing Director / Chief Executive Officer of GTBank said: “Understanding that customers are always on the go; mobile banking puts us in the palm of our customers and provides a unique opportunity to offer quick and more efficient ways of providing banking services. As a Bank, we remain firm on our objective to deliver value adding services that are tailored to meet the diverse needs of our ever-growing customer base by leveraging technology to make banking more convenient for all our customers.”

GTBank has consistently played a leading role in Africa’s banking industry. The GTBank brand is regarded by industry watchers as one of the best run financial institutions across its subsidiary countries and serves as a role model within the financial service industry due to its bias for world class corporate governance standards, excellent service quality and innovation.