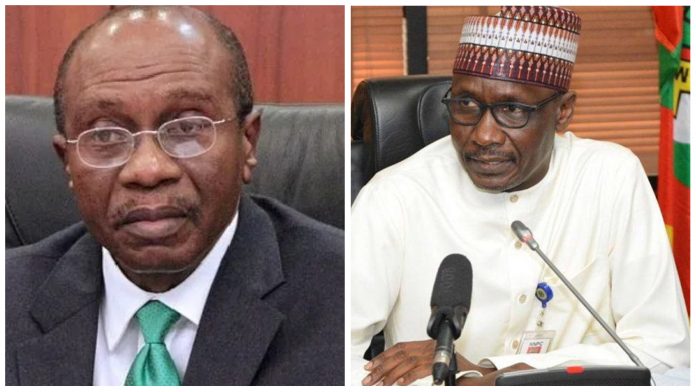

The Nigerian National Petroleum Company Limited (NNPC), has tackled the Central Bank of Nigeria (CBN) for blaming it for the continuous depreciation of the naira, which the latter revealed was due to the former’s refusal to remit dollars into the country’s foreign reserves.

BizWatch Nigeria reported that CBN explained that NNPC and its subsidiaries have failed to remit the USD to Nigeria’s foreign reserves. Hence, the foreign exchange (FX) market is suffering from an acute shortage of the foreign currency.

“Considering Nigeria’s heavy dependence on oil exports for foreign exchange earnings and government revenue, the impact of the oil market crash severely affected the government’s naira revenue and other macroeconomic aggregates including economic growth.

“Hence, the rate of exchange between the naira and other currencies has widened over the past few years,” CBN had stated.

However, a document that tackles the claim from NNPC, indicated that the state-owned oil and gas firm remitted a total of N2.7 billion into its accounts with the Central Bank from January to June this year.

The document also stated that out of the $2.7 billion the oil firm remitted into its CBN accounts, $645 million was for dividends paid by the Nigerian Liquefied Natural Gas company Limited (NLNG)

It added that $1.786 billion was from the operational activities of the national oil company, which recently transited into a limited liability company.

A look into remittances from NNPC to CBN since January

The document shows that the funds remitted by NNPC to CBN since the year 2022 started include -$18,770,418.97 in January; $194, 563, 276.49 in February; and $373, 232,875.20 in March.

Others were $247,884,295.52 remitted in April 2022: $591,565,425.41 in May; and $880,906,761.81 in June 2022.