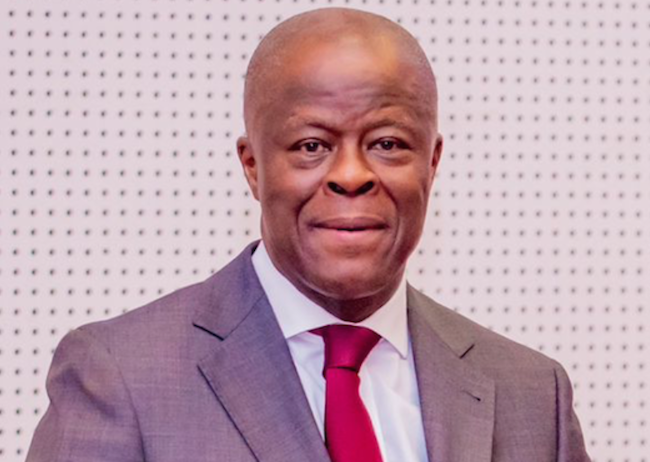

Nigeria’s Federal Government has acknowledged a substantial revenue shortfall in the 2025 fiscal year, with actual earnings falling far below projections used to underpin the national budget, according to the Minister of Finance and Coordinating Minister of the Economy, Wale Edun.

Appearing before the House of Representatives Committees on Finance and National Planning on Tuesday, Edun disclosed that while the Federal Government had projected total revenue of ₦40.8 trillion for 2025, current fiscal performance indicates that inflows are likely to close the year at approximately ₦10.7 trillion.

The minister made the revelation during an interactive session focused on the 2026–2028 Medium Term Expenditure Framework (MTEF) and Fiscal Strategy Paper (FSP), documents that outline the government’s medium-term economic assumptions and spending priorities.

Edun reminded lawmakers that the ₦40.8 trillion revenue target for 2025 was designed to fund the ₦54.9 trillion national budget, which the administration described as a “budget of restoration.” The spending plan was intended to stabilise the economy, reinforce national security, and lay the groundwork for sustained economic growth.

However, he admitted that actual revenue performance has diverged sharply from expectations.

“Based on the current trajectory, federal revenues for the full year will likely end at around ₦10.7 trillion compared to the ₦40.8 trillion projection,” Edun told the committees.

Oil Revenue Weakness Drives Shortfall

The finance minister attributed the revenue gap largely to weak performance in the oil and gas sector, particularly lower-than-expected receipts from Petroleum Profit Tax and Company Income Tax paid by oil and gas companies.

He also pointed to persistent underperformance across several revenue streams, noting that structural inefficiencies and external pressures have continued to weigh on government earnings.

The disclosure contrasts sharply with comments made by President Bola Tinubu in September, when he told members of The Buhari Organisation during a visit to the Presidential Villa that Nigeria had already met its revenue target for the year.

“Today I can stand here before you to brag: Nigeria is not borrowing. We have met our revenue target for the year, and we met it in August,” the president had said at the time.

However, Edun acknowledged that the revenue shortfall significantly constrained the implementation of the 2025 budget.

Borrowing Fails to Bridge Funding Gap

According to the minister, the Federal Government raised about ₦14.1 trillion through borrowing during the year. Even with these funds added to actual revenue inflows, total available resources remained far below what was required to fully finance the ₦54.9 trillion budget.

Despite the funding gap, Edun said the government had continued to meet its most critical obligations through what he described as prudent and innovative treasury management.

He explained that salaries, statutory transfers, and both domestic and foreign debt service obligations had been settled as they fell due, despite limited fiscal space.

“These commitments were met through skillful, imaginative and creative handling of available resources,” the minister said.

Capital Spending Performance and Fiscal Caution

Providing additional insight into spending performance, Edun disclosed that capital releases to ministries, departments, and agencies in 2024 amounted to ₦5.2 trillion out of a budgeted ₦7.1 trillion, representing a 73 per cent implementation rate.

He added that when multilateral- and bilateral-funded projects were included, total capital expenditure reached ₦11.1 trillion out of ₦13.7 trillion, translating to an 84 per cent performance level.

The minister warned that expenditure plans heavily dependent on oil revenues must remain flexible, cautioning against committing government resources based on projections that have repeatedly failed to materialise.

“We must be ambitious, but based on the experience of the past two years, spending linked to these revenues must be tied strictly to funds that actually come in,” Edun said.

Debate Over Revenue Assumptions Continues

Also addressing lawmakers, the Minister of Budget and National Planning, Atiku Bagudu, said the MTEF and FSP were prepared following extensive consultations with key stakeholders, including government agencies, private sector representatives, civil society organisations, and development partners.

Bagudu acknowledged that revenue assumptions remained a major point of debate within the Economic Management Team. He explained that while some officials favoured conservative projections anchored on historical performance, others pushed for more ambitious targets to compel revenue-generating agencies to improve efficiency and collections.

He disclosed that although the government maintained an oil production target of 2.06 million barrels per day for policy planning purposes, a more cautious assumption of 1.84 million barrels per day was adopted for revenue calculations in the 2026 budget framework.

Earlier, Chairman of the House Committee on Finance, James Faleke, urged the executive to adopt a more realistic approach to budgeting, warning that overly optimistic revenue projections often lead to bloated budgets with serious implementation challenges.

Nigeria’s revenue performance in 2025 has been shaped by a combination of structural weaknesses and cyclical pressures, underscoring ongoing concerns about fiscal sustainability.