On Tuesday, ITC Judge Mary Joan McNamara dropped the bombshell revelation that she is planning to recommend a ban on some China-made iPhone imports, in a ruling that caused Apple stock to crater in afternoon trading.

Judge Recommends Partial iPhone Ban

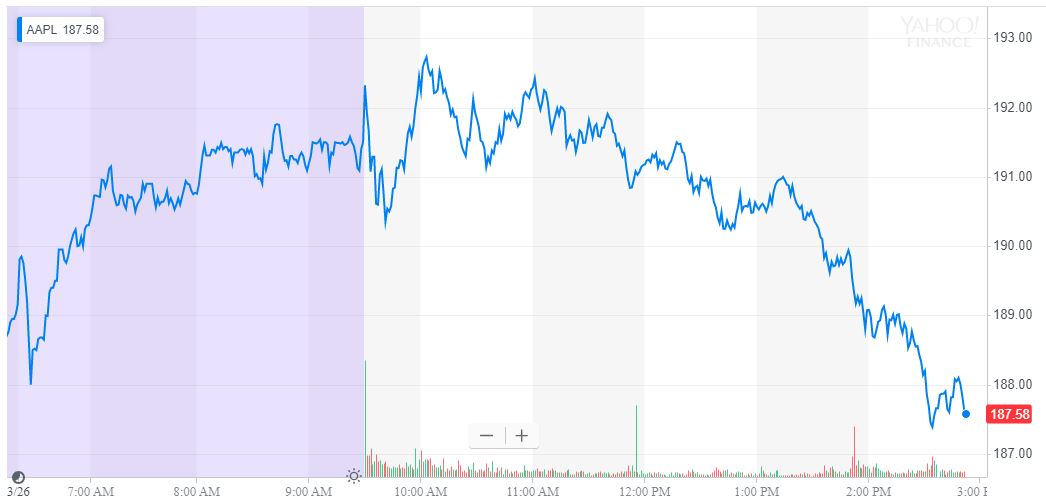

Already in decline, Apple stock slipped further after a trade judge recommended a partial iPhone ban. | Source: Yahoo Finance

Judge McNamara reportedly found that the company infringed on Qualcomm patents, and it remains unclear whether the recommendation of the judge will be materialized in the near-term, as it has to be approved by the commission.

The statement issued by Judge McNamara to the United States International Trade Commission read:

“I have found that Complainant, Qualcomm Incorporated (“Qualcomm”), has proven by a preponderance of evidence that Respondent, Apple, Inc. (“Apple”), has violated subsection (b) of Section 337 in the importation into the United States, the sale for importation, or the sale within the United States after importation of certain mobile electronic devices containing processing components.”

While the share prices of both Apple and Qualcomm saw immediate effect following the release of the ruling, some analysts claim that the slight retrace in Apple stock is bigger than the ruling itself.

Other Factors Causing Apple Stocks to Decline

Since late 2018, due to the plateauing growth of mobile phone technology, the sales of mobile phone manufacturers in the likes of Apple and Samsung have struggled to meet the expectations of Wall Street analysts.

Especially in markets like China wherein local phone makers have been successful in offering lower cost alternatives targeted at the local consumer base, Apple has found it challenging to dominate in certain markets as it has done before.

On March 25, to diversify its products and widen the range of revenues for the company, Apple announced its entrance into the services industry, releasing products such as Apple TV+, Apple Arcade, and Apple News+.

If successful, these services would provide Apple new sources of revenue that may relieve some of the pressure being placed on the company’s long-term growth following reports of stagnating iPhone demand.

However, in the short-term, Goldman Sachs analyst Rod Hall said that the new services of Apple would not have an immediate impact on the revenues of Apple.

Hence, while the company’s shift away from its dependence on iPhone sales is positive, in the near-term, its effect on the company may be minimal.

The Goldman Sachs analyst wrote:

“Though all of these services are interesting from a platform churn point of view none seem likely on our calculations to materially impact earnings per share in the short term. With small calculated impacts from these ‘Other services,’ we expect the focus to return to the slowing iPhone business post this event.”

“Apple’s Services reveal was materially different than we had anticipated. We were surprised that Apple announced the launch of a video service this Fall rather than sooner with no pricing information provided at the event.”

Short-term Risks Could Spark Long-term Growth

It is possible that Apple is risking short-term growth to establish a robust foundation for the long-term health of the company.

Regardless, many strategists remain cautiously optimistic in the long-term growth of Apple but in the foreseeable future.

It is also important to take into consideration that AAPL shares have surged by 31.9 percent since January 3, from $142.19 to $187.61, and the company is in an ideal position to take some risks to improve the financial stability of the firm.