Bismarck Rewane, the Chief Executive Officer (CEO) of the Financial Derivatives Company Limited, has revealed that the failure of the Central Bank of Nigeria (CBN) to make the amount of new naira notes that beat the old notes in circulation available, is why the country is experiencing a cash crunch.

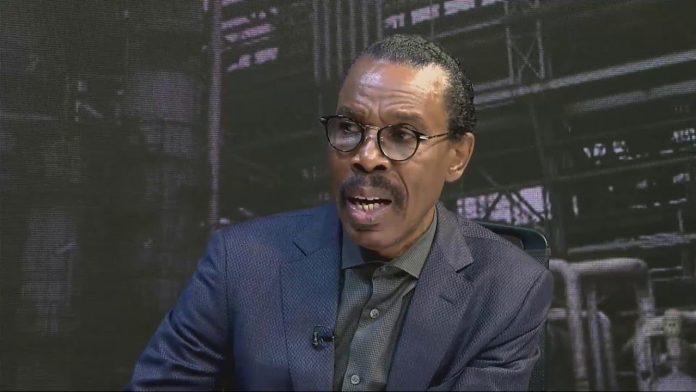

Rewane made this submission during his presentation at the Lagos Business School.

In the presentation, the economic expert estimated that the “total new naira notes printed is N400 billion, which left a Naira cash shortfall of N2.31 trillion, which is about 77% of total cash in circulation that has led to a near paralysis of commercial activities.”

Rewane, however, projected that Nigeria would suffer a total Gross Domestic Product (GDP) loss of $18 million and a total man-hour loss of 120 hours (five days) per month due to the disruption in economic activities that are triggered by the implementation of currency swap of the old notes by CBN.

The Financial Derivatives chief made this projection as he attributed the decline in GDP growth to a reduction in the velocity of money circulation and total man-hours loss in the economy.

He projected that the “total man-hour loss in a month will be 120 hours and total GDP loss in a month will be $18 million.”

“Trade is settled mainly in cash and POS (though) 70 percent of trading transactions are settled by cash. Therefore, the velocity of circulation in the trading sector (16 times) is approximately four times more than the formal sector. A decline in the velocity of circulation could reduce output in the trading sector. Hence its contribution to GDP will fall,” Rewane explained.

According to him, trade contributed 16% of the formal GDP and employed 17% of the total labour force in Nigeria.