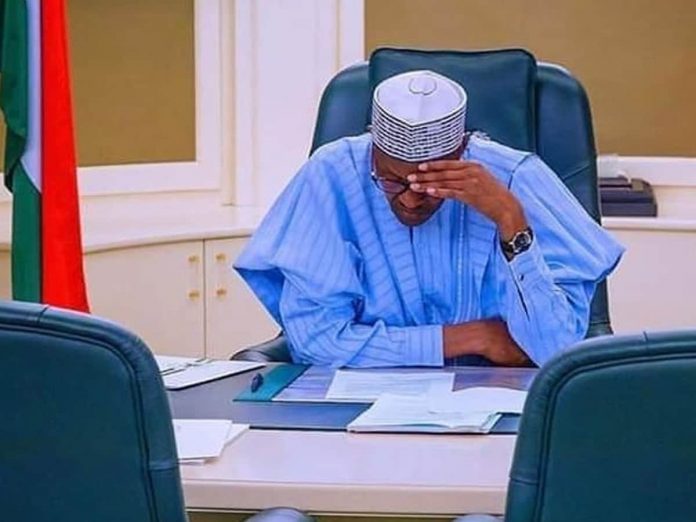

President Muhammadu Buhari has been hit with more things to worry about, as China, Africa’s largest bilateral creditor, is scaling down lending to the continent amid its worsening growth woes.

Bloomberg reports that this development comes at a time of rising interest rates globally and shrinking liquidity, factors that have already sent bonds of the riskiest African borrowers such as Ghana and Zambia crashing, and currencies including South Africa’s rand to near COVID-19 lows.

Nigeria’s debt to China

BizWatch Nigeria understands that China is Nigeria’s biggest country creditor. At the time of filing this report, the Buhari-led country owes Beijing $3.9 billion, a 12.7% increase from $3.5 billion in the same period last year.

This development comes as the Debt Management Office (DMO) recently revealed that the Federal Government (FG), between January and June 2022, spent N1.87 trillion repaying matured loans.

The loans include those obtained from foreign countries and organizations and those obtained from citizens (domestic market).

A breakdown from the report shows that out of the total debt service, N1.33 trillion went to domestic creditors while N536.16 billion was to foreign creditors.

Meanwhile, the Lagos Chamber of Commerce and Industry (LCCI) had advised FG to stop incurring more debts, and consider leveraging equity for budget deficit financing instead.

LCCI’s President Michael Olawale-Cole made this submission in a statement in which he expressed his outright disapproval of the FG’s rising debt stock.

Advising the FG to discontinue Nigeria’s rising debt portfolio, Olawale-Cole said: “the fact that the most recent statistics on government revenues show a poor performance and mounting government costs makes it evident that Nigeria is going through a debt crisis.