- Analysts optimistic on positive market outlook

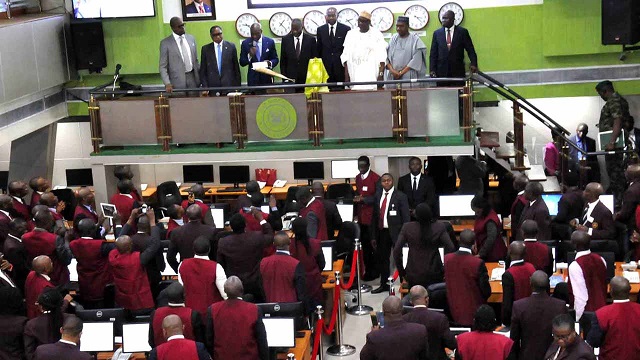

At the end of last week’s transactions on the equity sector of the Nigerian Stock Exchange (NSE), the bearish performance in the local bourse was sustained as the NSE’s market capitalisation dipped by N239 billion in four trading days.

Specifically at the close of transactions for the week, market capitalisation dropped by N239 billion from N14.992 trillion recorded last week Thursday to N14.753 trillion.

Also, the All-share index, which measures the performance of, listed equities declined by 663.37 points or 1.6 per cent, from 41,504.51 to 40,841.14.

The drop in indices may however be attributed to the holiday declared by federal government on Monday to commemorate the Easter celebrations. Also, sustained sell-offs in major highly capitalised stocks also contributed to the slide indices.

Stock market analysts predict positive outlook on the market, even as firms continue to release strong 2017 earnings and expectations of impressive Q1 result.

Specifically, analysts at Codros Capital Limited said: “We therefore maintain our positive outlook on the market in the near term following the release of strong FY 2017 earnings and expectation of impressive Q1 2018 results.”

Afrinvest Securities Limited said: “We reiterate our positive outlook for risky assets, on the backdrop of still-positive macroeconomic fundamentals, downtrend in yields on debt instruments, and lower stock prices, which is expected to drive bargain hunting ahead of Q1-18 corporate releases.”

Further analysis of last week’s transactions showed that a total turnover of 1.765 billion shares worth N26.562 billion deals were recorded in 20,265 by investors on the floor of the Exchange in contrast to a total of 2.328 billion shares valued at N28.927 billion that was exchanged in 25,530 deals during the preceding week.

The financial services industry (measured by volume) led the activity chart with 1.468 billion shares valued at N18.707 billion traded in 12,850 deals; thus contributing 83.18 per cent and 70.43 per cent to the total equity turnover volume and value respectively.

The conglomerates industry followed with 127.882 million shares worth N623.871 million in 971 deals. The consumer goods ranked third with a turnover of 69.868 million shares worth N6.189 billion in 2,930deals.

Trading in the top three equities namely – Zenith International Bank Plc, Access Bank Plc and United Bank for Africa Plc (measured by volume) accounted for 543.758 million shares worth N9.739 billion in 3,533 deals, contributing 30.81 per cent and 36.66 per cent to the total equity turnover volume and value respectively.

Also traded during the week were a total of 125,282 units of Exchange Traded Products (ETPs) valued at N2.835 million executed in 11 deals, compared with a total of 15,293 units valued at N254,840.00 that was transacted last week in 16 deals.

A total of 4,457 units of Federal Government Bonds valued at N4.247 million were traded this week in 13 deals, compared with a total of 21,583 units valued at N22.868 million transacted last week in 16 deals.

Similarly, all other indices finished lower during the week 19 equities appreciated in price during the week, lower than 40 of the previous week. 53 equities depreciated in price, higher than 40 equities of the previous week, while 99 equities remained unchanged higher than 91 equities recorded in the preceding week.

The price of Zenith International Bank Plc was adjusted on the 4th of April, 2018 for a dividend of N2.45 as declared by the board of directors. The last close price was N29.80, hence the ex-div price N27.35.