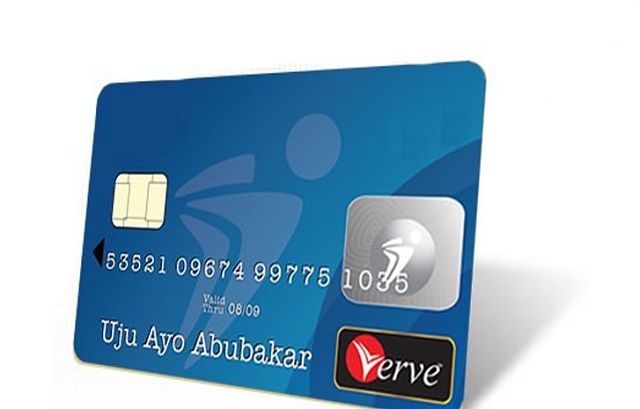

The evolution of the Verve brand from being a local player to competing internationally reflects the company’s drive to give broader access to Nigerian business and leisure travelers, beyond the shores of Africa. Having succeeded with the Verve Classic product since its launch in 2008, the company seems ready to conquer the world with yet another product offering.

The spotlight was on New York recently, with the launch of the Verve Global card. Senior executives from Interswitch, Discover Global Network and top bank executives Gbenga Francis Shobo, Deputy Managing Director at First Bank of Nigeria, Olubusola Osilaja, Divisional Head, eBusiness at Access Bank and Martins Izuogbe, Divisional Head, Operations, at Fidelity Bank, witnessed the historic event.

The launch of Verve Global card is a welcome development in Nigeria’s card payment market and to the Nigerian economy. The sector, once controlled predominantly by foreign card schemes, has witnessed the emergence and upward trajectory of an indigenous brand, tailored to the economic realities of the African markets it caters to. It also strikes a chord of pride for Nigeria, symbolizing the fulfillment of an aspiration for global participation in an industry treaded solely by companies of technologically advanced economies.

This collaborative deal would see the Verve Global card ride on the expansive network of Discover which has coverage in over 190 countries and territories.

This strategic partnership comes with the robust technology and wealth of experience brought by Discover Global Network – the payments brand of Discover.

Interswitch, on the other hand, comes with custom-built technology that addresses e-payment pain points across its various markets in Africa. It also brings its increasing network of platforms spanning 21 African countries to the partnership.

While this new offering might seem like a business expansion move for Verve, it also opens a vista of opportunities for the stakeholders across the value chain.

For cardholders, this expands the array of card options available to them and allows holders to enjoy competitive exchange rate when making cross border payments to merchants affiliated with the Verve, Discover, Pulse and Diners Club.

Nigerian banks have the opportunity to expand their suite of card offerings and customize solutions targeted at underserved customers. Also, for ATM withdrawals overseas daily limits are determined by the issuing bank.

According to the Central Bank of Nigeria Q1, 2019 report, over ₦1.5 trillion was processed through ATMs in over 2 million transactions.

Understandably, Nigeria being a huge market requires the presence of indigenous businesses to compete in such critical sectors, in order to develop local expertise, integrate homegrown solutions unique to the environment and capture revenue that would have otherwise been lost to foreign players.

Speaking at the Verve Global card launch and partnership with Discover Global Network, Mitchell Elegbe, Interswitch Group Managing Director, said, “The agreement with Discover Global Network will enable Verve to compete with other global card offerings, providing cardholders with an enhanced customer experience when transacting globally outside Nigeria. Creating a solution which facilitates international payments for our consumers will help to eliminate existing barriers and simplify the process when transacting abroad.”

Also, the Senior Vice President of International market at Discover, Ricardo Leite, stated: “It is important to us that we are working with groups around the world to extend acceptance for their cardholders. At Discover, we recognize the importance of being able to use your card of choice no matter where you are traveling.”

Mike Ogbalu III, Verve International Divisional Chief Executive Officer, also commented on the announcement saying: “The launch of the Verve Global Card, provides consumers with the ability to transact globally across the US and other countries, addressing challenges that many Nigerians have experienced while travelling abroad. Our partnership with Discover Global Network will help us to optimize the overall experience of every Verve Global card holder by guaranteeing consistent and efficient payment solutions regardless of where they are in the world”.

Since its launch, banks have begun issuing the Verve Global card to their customers.