- Funding rates Spike as CBN Mops up Excess System Liquidity

- Nigeria States’ Internally Generated Revenue Climbs 12% in 2017

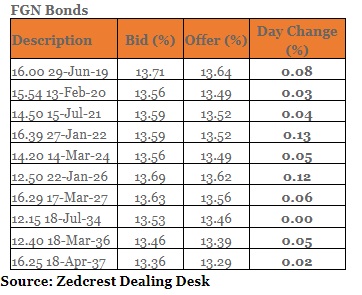

Bonds

The bond market remained bearish in today’s session with slight sell especially on the 2027s taking yields higher by c.6bps for the second consecutive trading session. We however witnessed some resistance when yields began to hit the 13.60% area, with slight retracements on the 27s and 37s before the close of trading. We expect this bearish trend to persist however, as demand for bonds remain relatively weak in the market, with most support seen from offshore buyers.

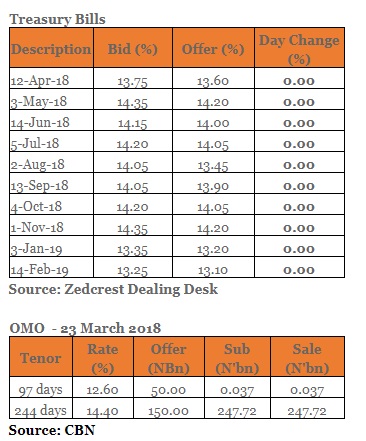

Treasury Bills

The T-bills Market traded on a relatively quiet note, with very little in the way of flows, as the CBN resumed its OMO auction, selling a total of c.N248bn of the 22-Nov bill. Yields consequently stayed flat, compressing just slightly by 1bp on average. We expect renewed buy sentiments in the coming week, as market players anticipate significant fund inflows from retail FX refunds and FAAC and OMO T-bill maturities later in the week. The CBN is however expected to increase its OMO auction tempo, to calm liquidity pressures in the system.

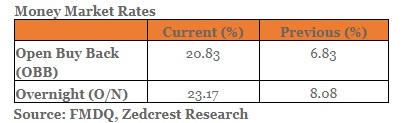

Money Market

The OBB and OVN rates spiked by c.14 percent points back to their previous day levels, closing at 20.83% and 23.17% respectively. This came on the backdrop of a significant OMO sale by the CBN c.N248bn and debits for bond auction settlement c.64bn. System liquidity is consequently estimated to close at c.N60bn long, from a positive opening figure of c.N370bn. We expect rates to remain elevated on Monday, due to expected outflows for OMO and wholesale FX sales by the CBN.

FX Market

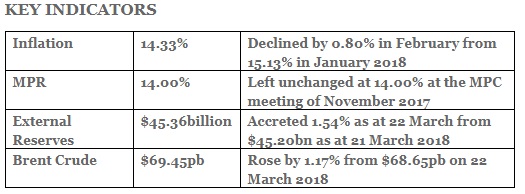

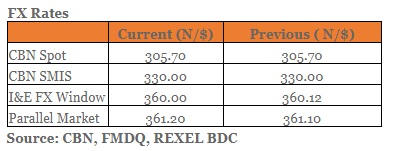

The Interbank rate remained stable at its previous rate of N305.70/$, with the CBN’s external reserves recorded to have improved by 1.54% to $45.36bn as of 21 March. The NAFEX rate appreciated by 0.03% to N360.00/$, with total volume traded rising by 66% to $259m. Rates in the Unofficial market however depreciated by 0.03% to N361.20/$.

Eurobonds

The NGERIA Sovereigns turned bearish in today’s session, reversing gains witnessed in the previous session. Yields rose by c.6bps on average with some selloffs especially on the 15– and 30-yr. Prices were also down by –0.3pts with the 47s losing as much as –0.6pts, as the 18s, 27s and 47s edged closer to par.

The Nigerian Banks were largely bearish on all tickers except, except for the FIBAN 18s which retraced slightly from selloffs witnessed in previous sessions. Investors were mostly bearish on the Access 21s Senior and the UBANL and FIDBAN 22s. The SEPLLN 23s was last traded at 99.75.

Source: Proshare