By all means, the Nigerian government must be seen to promote policies that contribute to food security. Suffice it to mention, that food security remains a critical indicator of national security.

According to World Health Organisation (WHO) 1992 and Food and Agriculture Organisation, (FAO)1996, food security refers to the condition in which all people, at all times, have physical, social, and economic access to sufficient, safe, and nutritious food that meets their dietary needs and food preferences for an active and healthy life.

The second side of the coin is food insecurity, which implies insufficient food intake, lack of access to foods of adequate dietary quality, anxiety over food supplies, and having to acquire food in socially unacceptable ways (Bickel et al. 2000).

The import of these conceptual definitions underscore the significant role food plays in producing a population who will contribute positively to social, economic and political developments of any nations.

The place of importation in the food security equation is best explained by the supply side of food security that has to do with food availability. Food availability is determined by the level of domestic food production, stock levels, and net food trade.

This implies that food, agro-allied, and related commodities importation is inevitable. The top food and agricultural imports into Nigeria are wheat, fish, brown sugar, food ingredients, and consumer-oriented foods.

From the theoretical viewpoint, it is therefore advisable that a country should only import commodities where it does not enjoy comparative production and trade advantages. It is therefore trite that aspects of food needs that cannot be met locally should be met through importation.

With the strategic importance of food importation, there is no gain in saying that fair and equitable economic incentives should underpin all charges relating to agro-allied and related commodities import.

Consumers’ Current Economic Realities

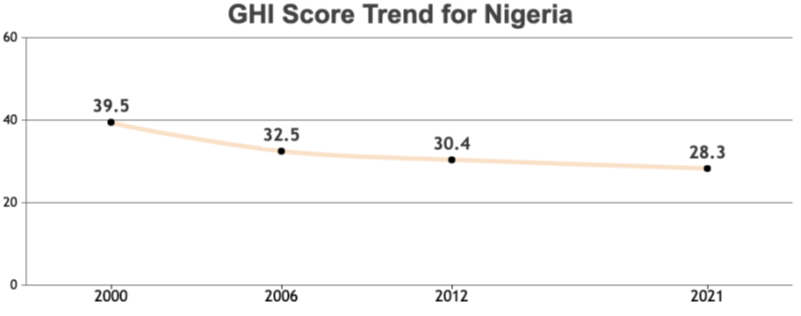

The grim status report of Nigeria on wide-ranging food and food-related issues leaves nothing to be desired. The country is at a time when the monthly national minimum wage is eighteen thousand naira (N18,000.00) when Nigeria is labelled the poverty capital of the world with a headcount of about 91 million people in poverty in 2021; and when Nigeria has a Global Hunger Index score of 28.3 indicating a serious level of hunger and ranked 103 out of 116 countries assessed in 2021.

It is therefore important for government policies relating to food to be pro-food security and pro-poverty reduction.

It is imperative at this point to advance reasons why it is counterproductive for the Nigeria Customs Service to charge spot prices for import duties on agro-allied goods and other raw materials for food processing from the theoretical economic viewpoint and considering present economic realities. (See chart 1 below)

Chart 1 Global Hunger Index: Nigeria

Food Security, Inflation and Poverty

The Institute of Development Studies, United Kingdom in a report of a study on global food affordability in 2021 opined that the average Nigerian spends 101% of the monthly income on food and ranked her as the second poorest country in food affordability out of 107 countries.

This in addition to a declining disposable income,which according to National Bureau of Statistics (NBS) fell by 2.54% between 2020 and 2021 indicates deterioration in the standard of living of the average Nigerian, and calls for serious concern.

Therefore, any policy that increase prices in the food value chain will ultimately translate to increase in final prices of manufactured food and reduce the amount available to household to purchase food. It will further hurt inflation.

The impact on employment and capacity utilization of manufacturing industries, these are two closely related issues. The level of industrial capacity utilization was 55.80 % in the third quarter of 2021 according to the trading economics website. The consistent rise in Inflation continued to bite hard and to threaten the country’s manufacturing potential.

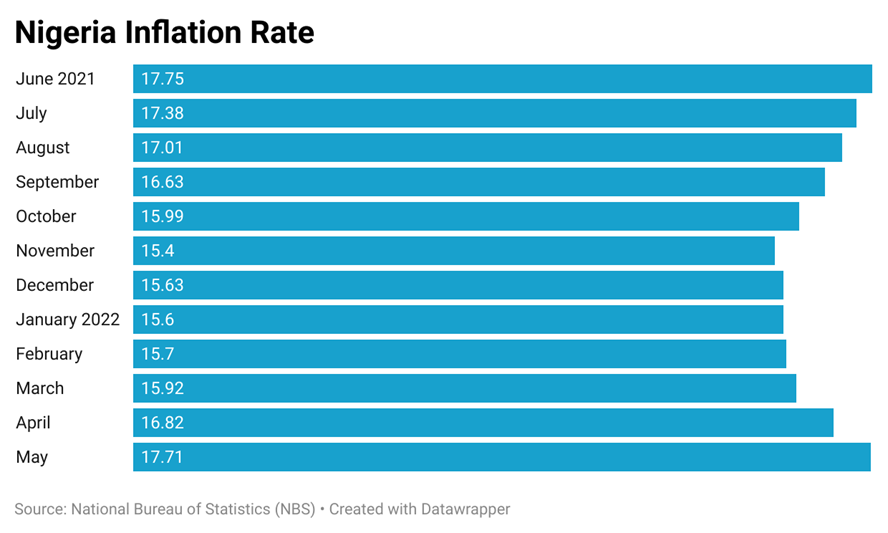

According to the NBS the inflation estimate hit an all time high for the year with an estimate of 17.71 % in May 2022,and an increase over the April estimate.

This will further fuel an increase in the prices of factors of production, particularly energy and imported raw material thus increasing the cost of production and final goods.

However, In the face of static consumer incomes, the disposable income of consumers will continue to shrink, likewise effective demand for goods and services. (See chart 2 below)

Chart 2 Nigeria Inflation Rate June 2021-May 2022

The Burden of Government’s Revenue Drive

It was gathered that the House of Representative Committee on Customs and excise set for the service a 2022 revenue generation estimate of N4.1 trillion as against the N2.23 trillion generated in 2021.

As good as this estimate looks, the resultant gains in national income through the multiplier effect arising from provision of goods and services will far exceed the supposed gains from the spot price duty policy.

Media reports on Tuesday, June 28, 2022, revealed the Nigeria Customs Service (NCS) disclosed to the chairman and members of the House of Representatives Committee on Customs and Excise in Lagos on Monday that it is committed to meeting its N4.1 trillion revenue generation target in the 2022 budget, noting that it had realised N1.2 trillion at present.

While this may sound laudable, the downside of this aggressive revenue drive is the regulatory overzealousness it forces the custom into, like spot price valuation duty charge and for which the Nigerian populace sadly must pay the heavy price in the resultant exorbitant cost of food products in the market.

The importance of revenue generation cannot be overemphasized but definitely not to detriment of the economy it is intended to support.

Spot Price Duty Valuation

The spot price duty will also further fuel inflation. Food represents an important element of the CPI calculation and food expenditure consumes the entire income of the average Nigerian.

It is in this light that the current spot price duty valuation operated by the Nigeria Customs Service should be reversed in favour of valuation based on the transaction value of the commodities being assessed.

The spot price duty is calibrated based on the Consumer Price Index (CPI), which is used as a measure of the level of inflation.

The CPI computation takes into cognisance bundles of goods other than food and it will therefore be misleading to utilize this estimate of the rate of inflation to assess the duty value for agro allied importation.

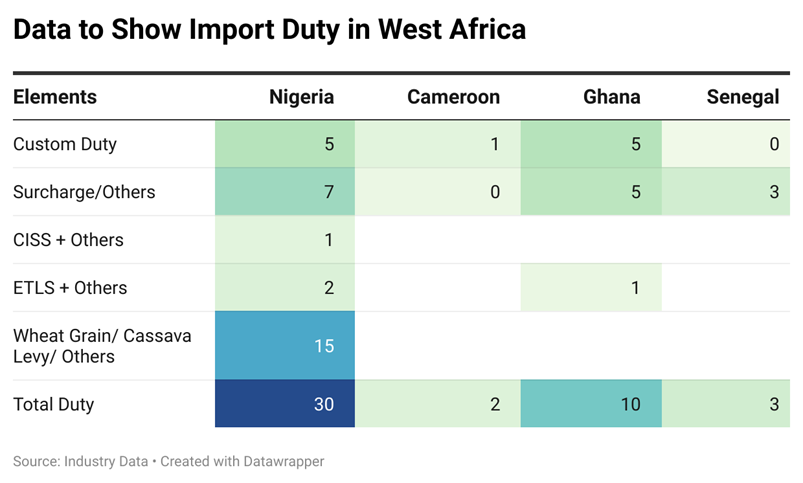

The economics of this practice is that the resultant misleading price is transmitted to other levels in the food value chain causing harm in form of rising food prices, high cost of raw materials for manufactured foods thus further restricting access to food and undermining the food access dimension of food security. (See chart 3 below)

Chart 3 Import Duties of Some West African Countries

Regulatory/ Operating Environment

It is therefore important that there is a rein on prices of imported agro-allied goods and other essential imported raw materials to save the manufacturing sector and employment.

One of the indices of ease of doing business is a stable fiscal environment. When government policies are unpredictable, it becomes difficult for business owners to plan and make good business projections.

This also has consequences for the attraction of new local and foreign direct Investments (FDI). Another good argument for a stable fiscal environment is that it helps to complement the monetary side of the economy and to better curtail inflation.

Lastly, the administration of import duty should display professionalism. According to best trade practice, the World Trade Organisation(WTO) stipulates that countries should trade on the principle of “Most Favoured Nation” (MFN), which requires that members should accord the most favourable tariff and regulatory treatment given to the product of any one member at the time of import or export of ‘’like products” to all other members.

This resonates with the principle of retaliatory treatment and suggests that our exports to other countries that are victims of our unfriendly spot duty policy may be given similar treatment. Nigeria will need to copy fair practice like that of Cote d’Ivoire, a neighbouring West African Countries with an average of 34% bound tariff lines at an average WTO tariff rate of 11.2% compared to 96.6 % and 120.9% for Ghana and Nigeria, respectively.

This variation implies unfairness and it, therefore, makes sense for import duty to be assessed based on the transaction value of the items being imported.

This is not only seen as being fair and objective, but it introduces correct price transmission at the other levels of the food value chain and also allows for the competitiveness of goods and services produced in the country.

It is needless to say that there is no incentive for smuggling when prices are competitive. Thus spot pricing is counter-productive to its initial intention of revenue generation.

Conclusion

However, it must be noted that there are challenges with an assessment based on the value of commodities due to fraudulent and unscrupulous importers who will under-invoice to defraud the system.

The Global Financial Integrity (2018) noted that import under-invoicing in Nigeria totaled US$2.4 billion in 2014 or just over 10.5 % of total imports computed for that year. It also states further that the potential loss of import duties due to import under-invoicing was US$365 million in 2014, or 10 percent of total customs duties and excise tax revenues.

These are very staggering estimates, It is therefore important that the Nigeria Customs Service should strengthen its price intelligence unit to keep her abreast of prevailing prices of commodities and should also push for legislation for tough sanctions on importers that engage in sharp practices. This in the least will serve as an incentive to protect importers that have decided to play by the rules.

Conclusively, it is therefore in the best interest of Nigeria to discontinue the spot price import duty policy to promote trade facilitation and enforce a healthy fiscal policy, which is its primary constitutional mandate.

Also, if the government is serious about food security as it claims, then there is no better time to implement a near-zero duty regime for agro-allied importers and food manufacturers to reduce some of the extra cost that negatively impacts their cost of production and consequently the prices of food commodities/ products in the market.

By Adetunji Kehinde, Professor of Agricultural Economics, Osun State University, Osogbo.